By most economic measures, the state of Florida isn’t expected to return to normal for at least another couple of years following the Great Recession. That’s the outlook the state’s chief economist delivered to the Legislative Budget Commission today.

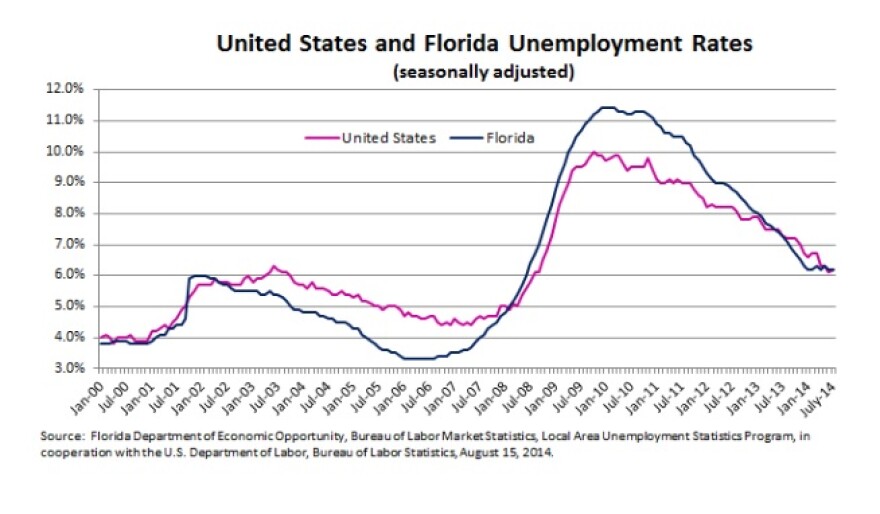

After falling steadily, Florida’s unemployment rate has stagnated at around 6 percent recently. That’s in line with the national rate. And the Legislature’s chief economist, Amy Baker, says there’s a good reason the unemployment rate hasn’t continued falling.

“We actually saw an increase in our labor force participation rate, and the effect of that, as more people became excited about the economy, joined the workforce, began actively looking for jobs, is that it flattened out our unemployment rate," she says.

Baker laid out that and many other financial-health indicators before the Budget Commission approved its three-year outlook. Another positive: The percent of delinquent mortgages has steadily decreased.

“So if you think of delinquent mortgages as a pipeline for how many things will hit the foreclosure process, we’ve shut that pipeline down or narrowed it," Baker says.

Florida’s foreclosure rank has dropped from first in the nation to No. 3.

However, Baker says, challenges loom. The home ownership rate is lower than it’s been since 1990, and the construction industry isn’t expected to fully recover until eight-to-10 years from now. Also, Florida’s workforce as a percent of its population will continue shrinking as Baby Boomers age and older people continue moving to the state.